Multiple Choice

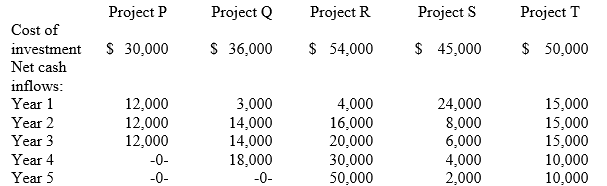

Madson Company is analyzing several proposed investment projects. The firm has resources only for one project.  The company uses the payback period method for making capital investment decisions. Based on this decision model, which project should be selected? (Ignore taxes and assume that cash inflows occur evenly throughout the year. Carry calculations out to two decimal places.)

The company uses the payback period method for making capital investment decisions. Based on this decision model, which project should be selected? (Ignore taxes and assume that cash inflows occur evenly throughout the year. Carry calculations out to two decimal places.)

A) Project P.

B) Project Q.

C) Project R.

D) Project S.

E) Project T.

Correct Answer:

Verified

Correct Answer:

Verified

Q139: The difference between the present value of

Q140: Consider two projects, A and B. The

Q141: GuSont Inc. was considering an investment

Q142: Olsen Inc. purchased a $600,000 machine to

Q143: When the net present value (NPV) of

Q145: Brandon Company is contemplating the purchase of

Q146: Research has shown that in framing capital

Q147: Olsen Inc. purchased a $600,000 machine to

Q148: In capital budgeting, the accounting rate of

Q149: The Zone Company is considering the purchase