Multiple Choice

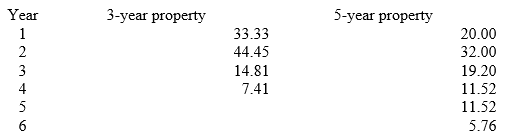

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine will produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered to be a 3-year property and is not expected to have any significant residual value at the end of its useful life. Marc's combined income tax rate, t, is 40%. Management requires a minimum after-tax rate of return of 10% on all investments. A partial MACRS depreciation table is reproduced below. What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

A) $62,000.

B) $114,000.

C) $170,000.

D) $240,000.

E) $37,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q120: Kravitz Company is planning to acquire a

Q121: A 15% internal rate of return (IRR)

Q122: Nelson Inc. is considering the purchase

Q123: Ignoring income tax considerations, how is depreciation

Q124: Which of the following is always true

Q126: Which of the following characteristics is not

Q127: Olsen Inc. purchased a $600,000 machine to

Q128: Fitzgerald Company is planning to acquire a

Q129: Megan Inc. has a policy of not

Q130: Which one of the following is an