Essay

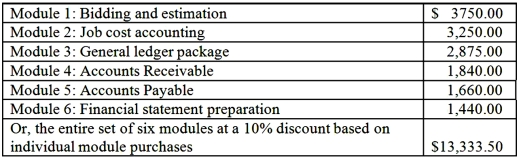

Acorn Corporation designs and installs fire-suppression systems in commercial buildings. Over 90 percent of Acorn's business is in new construction, with the remainder in upgrade installations in remodeled buildings. For planning and control purposes, Acorn's controller (Jane Reid) is considering purchasing cost and financial accounting software from Constructor Solutions, Inc. Costs for the software modules are shown below:  Required:

Required:

1. Jane uses value-chain analysis in evaluation of capital investments. She asks you which method, internal rate of return (IRR) or net present value (NPV), would be best in selecting individual software modules, and your reason(s) for the choice of method.

2. Jane says, "If we buy the entire set of six modules, we will get the equivalent of Module 6 free." Why might this savings of almost $1,500 be illusory?

3. The present value of the cost savings generated by the set of six modules, based on a five-year life and discount rate of 18 percent, is estimated as $13,844.50. Should the set of six modules be purchased? Explain. How would your decision be affected if Acorn's minimum rate of return were 24 percent? (No calculations are necessary to answer this question.)

Correct Answer:

Verified

1. Jane should use net present value (NP...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: Pique Corporation wants to purchase a new

Q70: Carmino Company is considering an investment

Q71: Said Company is considering the purchase of

Q72: Cash-flow analysis: If an existing asset is

Q73: The process of identifying, evaluating, selecting, and

Q75: The after-tax cost of debt for purposes

Q76: Two investments have the same total cash

Q77: Durable Inc.is considering replacing an old drilling

Q78: Quip Corporation wants to purchase a new

Q79: _ is the recommended method for determining