Essay

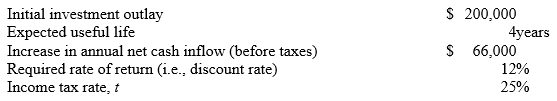

Harris Corporation provides the following data on a proposed capital project: Harris uses straight-line depreciation method with no salvage value.

Harris uses straight-line depreciation method with no salvage value.

Required:

Compute for the proposed investment project:

1. The project's estimated NPV (the PV annuity factor for 12%, 4 years is 3.037). Round your answer to nearest whole number (dollar).

2. The project's IRR (to the nearest tenth of a percent). Note: PV annuity factors for 4 years: @ 8% = 3.312; @ 9% = 3.240; @ 10% = 3.170; @ 11% = 3.102; @ 12% = 3.037; and, @ 13% = 2.974).

3. Payback period (assume that cash inflows occur evenly throughout the year); round answer to two decimal places (e.g., 4.459 years = 4.46 years, rounded).

4. Accounting rate of return (ARR) on the net initial investment, rounded to two decimal places (e.g., 10.4233% = 10.42%).

5. Discounted payback period (assume that the cash inflows occur evenly throughout the year; round your answer to 2 decimal places). The appropriate PV factors for 12% are as follows: year 1 = 0.893; year 2 = 0.797; year 3 = 0.712; year 4 = 0.636.

Correct Answer:

Verified

1. Annual increase in after-tax operatin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q114: Brandon Company is contemplating the purchase of

Q115: For capital budgeting purposes, a depreciation tax

Q116: Omaha Plating Corporation is considering purchasing a

Q117: Which of the following is an example

Q118: Olsen Inc. purchased a $600,000 machine to

Q120: Kravitz Company is planning to acquire a

Q121: A 15% internal rate of return (IRR)

Q122: Nelson Inc. is considering the purchase

Q123: Ignoring income tax considerations, how is depreciation

Q124: Which of the following is always true