Essay

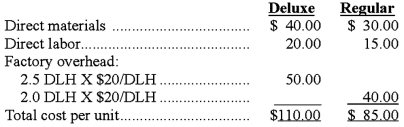

Swenson Company manufactures 4,000 units of Deluxe Product and 20,000 units of Regular Product each year.The company currently uses direct labor-hours to assign overhead cost to products.The pre-determined overhead rate is:  Suppose, however, that factory overhead costs are actually caused by the five activities listed below:

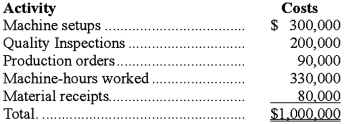

Suppose, however, that factory overhead costs are actually caused by the five activities listed below:  Also suppose the following transaction data has been collected:

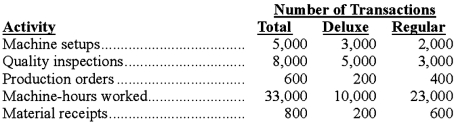

Also suppose the following transaction data has been collected:  Required:

Required:

Using the activity-based costing method to calculate unit costs of Deluxe and Regular products, and compare them with the current direct labor hours-based costing system.

Correct Answer:

Verified

Overhead rates for each of the five acti...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: Nerrod Company sells its products at $500

Q76: General corporate sales expenditures are:<br>A)Customer unit-level costs.<br>B)Customer

Q77: Cost to process monthly statements is an

Q78: Using a volume-based overhead rate based on

Q79: National Inc. manufactures two models of CMD

Q81: Zeta Company is preparing its annual

Q82: A volume-based rate is an appropriate overhead

Q83: If the usage of project activities is

Q84: Scott Cameras produces digital cameras and have

Q85: Sheen Co. manufacturers laser printers. It has