Multiple Choice

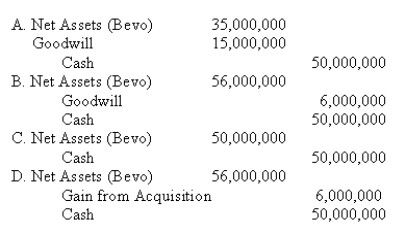

Canto Ltd,a Spanish corporation,acquired 100% interest in Bevo,Inc.,a U.S.corporation for $50,000,000. The net assets of Bevo had a book value of $35,000,000 and a fair value of $56,000,000. How should Canto record the business combination?

A) Entry A

B) Entry B

C) Entry C

D) Entry D

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Under ARB 51,"controlling financial interest "is:<br>A)not defined.<br>B)defined

Q33: Mega Corporation acquired 65% of the voting

Q35: Under both IFRS 8 and U.S.GAAP which

Q36: One difference that exists between IFRS 8

Q39: How is accounting for a pooling of

Q40: IFRS 3,issued in 2004,eliminated the use of

Q41: Which of the following are reasons to

Q42: According to both IFRS 8 and U.S.GAAP,which

Q49: Since 2003, what method for supplemental disclosure

Q50: How must Goodwill resulting from business combinations