Multiple Choice

Use the following to answer questions:

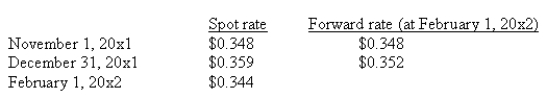

On November 1,20x1 Zamfir Company,a U.S.corporation,purchased minerals from a Russian company for 2,000,000 rubles,payable in 3 months. The relevant exchange rates between the U.S.and Russian currencies are given:  The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

-Assume that on November 1,20x1 Zamfir Company enters a forward contract to buy 2,000,000 rubles on February 1,20x2. How should Zamfir report the forward contract on December 31,20x1?

A) $8,000 asset

B) $7,800 asset

C) $22,000 asset

D) $7,800 liability

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Which of the following statements is true

Q16: Under U.S. GAAP, what is the proper

Q27: Why was there very little fluctuation in

Q31: A noncancelable sales order that specifies foreign

Q45: What has occurred when one company purchases

Q48: Under U.S.GAAP,to qualify for hedge accounting which

Q50: What was the effect of introducing the

Q51: A bank exchanging foreign currency makes its

Q53: In hedge accounting,which of the following items

Q57: What term is used for an option