Multiple Choice

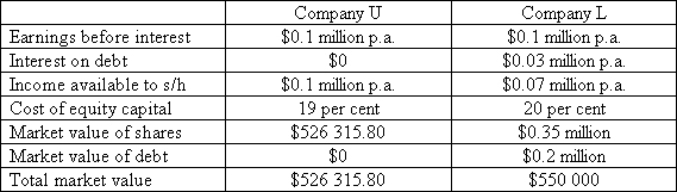

Given the following data,a suitable arbitrage opportunity for an investor with a 2% share in Company L would be to:

A) sell 1% shares in L,borrow on personal account and invest in shares of L.

B) borrow on personal account and buy more shares in L.

C) sell shares in L and buy 2% shares in U.

D) sell shares in L and buy 1% shares in U.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: An example of adverse incentive effects of

Q7: Which of the following statements is true?<br>A)Bankruptcy

Q8: A company with low financial leverage,large reserve

Q9: Financial risk comes about when:<br>A)new competitors emerge.<br>B)new

Q10: The 'traditional view' of capital structure argues

Q12: Which of the following is true of

Q13: The chance that a borrower will fail

Q14: The _ theory establishes a hierarchy of

Q15: Financial leverage exposes shareholders to financial risk

Q16: The effect of debt on the rate