Not Answered

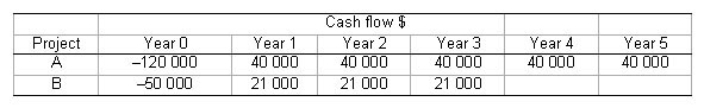

A company is to evaluate the following mutually exclusive investment proposals that involve the purchase of assets with different initial values and useful lives.The required rate of return is 10%.

A.Using the constant chain of replacement method which project should be chosen?

B.Using the equivalent annual value method which project should be chosen?

Correct Answer:

Verified

Correct Answer:

Verified

Q35: One of the limitations of decision-tree analysis

Q36: Which analysis involves assessing the effect of

Q37: Consider a machine that costs $20 000,has

Q38: Assume that an investment of $1000 is

Q39: If a firm is faced with a

Q41: The constant chain of replacement method of

Q42: The inclusion of _ as cash flows

Q43: Which of the following statements presents the

Q44: How would you go about conducting sensitivity

Q45: Red Brick Ltd is considering replacing its