Essay

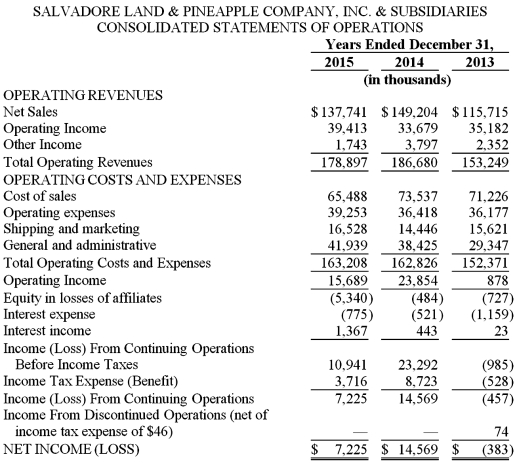

Salvadore Land & Pineapple Company,Inc.is a Hawaii corporation that consists of a landholding and operating parent company and its principal subsidiaries,including Salvadore Pineapple Company,Ltd.and Kapawau Land Company,Ltd.Refer to the excerpts that follow from the December 31,2015 annual report.All questions relate to the year ended December 31,2015 unless stated otherwise.Assume a 35% corporate tax rate where necessary.

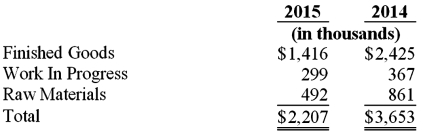

INVENTORIES:

Inventories of tinplate,cans,ends and processed pineapple products are stated at cost,not in excess of market value,using the dollar value last-in,first-out ("LIFO")method.

Agriculture product inventories were comprised of the following components at December 31,2015 and 2014:

The replacement cost of Agriculture product inventories at year-end approximated $8 million in 2015 and $10 million in 2014.In 2015 and 2014,there were partial liquidations of LIFO inventories;thus,cost of sales included prior years' inventory costs,which were lower than current costs.Had current costs been charged to cost of sales,income from continuing operations before income taxes for 2015 and 2014 would have decreased by $2.3 million and $2.9 million,respectively.

Required:

a.What amount of agricultural products inventory is on the balance sheet at December 31,2015?

b.Assume that ending inventory was overstated at December 31,2015.Explain how net income would be affected by the error.

c.The inventory note states that inventory amounts are "stated at cost,not in excess of market value,using the dollar value last-in,first-out ("LIFO")method." Which accounting principle or concept justifies writing down assets when market prices are lower than cost,but leaving them at cost when market prices are higher than cost?

d.How much has Salvadore Land & Pineapple Company deferred in income taxes since being on LIFO?

e.What impact did LIFO liquidations have on net income for the year ended December 31,2015? Explain why investors would want to know about this impact.

f.Compute the inventory turnover ratio to approximate physical unit flow for the year ended December 31,2015.

Correct Answer:

Verified

a.$2,207,000

b.Net income would be overs...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.Net income would be overs...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: It is possible to estimate the amount

Q65: Under a periodic inventory system,no entry is

Q66: The World Company's financial statements for

Q67: Goods available for sale needs to be

Q68: U.S.tax rules specify that if LIFO is

Q70: Tool City,Inc.had 300 cordless screwdrivers on

Q71: Jones Bros.Tools,Inc.had the following layers in

Q72: Cramer Corporation has two products in

Q73: The major issue in inventory accounting is<br>A)determining

Q74: GAAP requires the cost flow assumption to