Multiple Choice

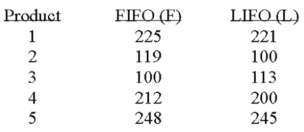

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?

What is the value of calculated t?

A) +0.933

B) 2.776

C) +0.47

D) -2.028

Correct Answer:

Verified

Correct Answer:

Verified

Q21: If two independent samples of size 10

Q23: A committee studying employer-employee relations proposed that

Q27: A national manufacturer of ball bearings is

Q28: A company is researching the effectiveness of

Q29: Accounting procedures allow a business to

Q30: Accounting procedures allow a business to

Q31: A study by a bank compared

Q51: If we are testing for the difference

Q61: If we are testing for the difference

Q75: If we are testing for the difference