Essay

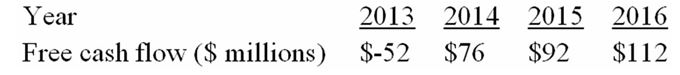

The following table presents a four-year forecast for Kenmore Air, Inc.:

-Estimate the fair market value of Kenmore Air's equity per share at the end of 2012 under the following assumptions:

a.EBIT in year 2016 is $200 million,and then grows at 5 percent per year forever.

b.To support the perpetual growth in EBIT,capital expenditures in year 2017 exceed depreciation by $30 million,and this difference grows 5 percent per year forever.

c.Similarly,working capital investments are $15 million in 2017,and this amount grows 5 percent per year forever.

Correct Answer:

Verified

FMV = PV{FCF,2013 - 16} + PV{Terminal va...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Empirical evidence indicates that the returns to

Q17: Assume BSL is worth the book value

Q18: The following table presents forecasted financial and

Q19: What is BSL's free cash flow (in

Q20: Estimate the present value of BSL's free

Q21: Which of the following statements is/are correct?<br>I.Going-concern

Q23: Atmosphere,Inc.has offered $860 million cash for all

Q24: The following table presents forecasted financial and

Q25: The following table presents forecasted financial and

Q31: Rainy City Coffee's (RCC)free cash flow next