Multiple Choice

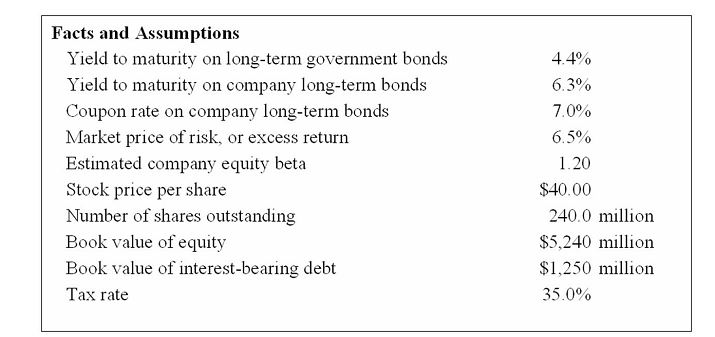

Key facts and assumptions concerning FM Foods, Inc. at December 31, 2011, appear below.

-Estimate the appropriate weight of debt to be used when calculating FM's weighted average cost of capital.

A) 11.5%

B) 19.3%

C) 80.7%

D) 88.5%

E) 100.0%

F) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The standard deviation of returns on Wildcat

Q11: The pre-tax cost of debt:<br>A) is based

Q12: The dividend growth model can be used

Q14: The excess return earned by a risky

Q15: When investment returns are less than perfectly

Q17: FM is contemplating an average-risk investment costing

Q18: Which of the following statements are correct

Q19: The discount rate assigned to an individual

Q20: Which of the following statements concerning risk

Q21: The cost of equity for a firm:<br>A)