Essay

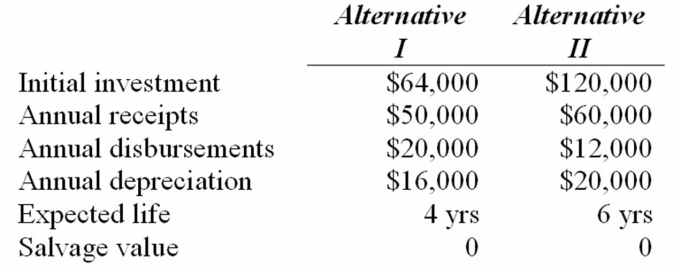

A company is considering two alternative methods of producing a new product.The relevant data concerning the alternatives are presented below.  At the end of the useful life of whatever equipment is chosen the product will be discontinued.The company's tax rate is 50 percent and its cost of capital is 10 percent.

At the end of the useful life of whatever equipment is chosen the product will be discontinued.The company's tax rate is 50 percent and its cost of capital is 10 percent.

a.Calculate the net present value of each alternative.

b.Calculate the benefit cost ratio for each alternative.

c.Calculate the internal rate of return for each alternative.

d.If the company is not under capital rationing,which alternative should be chosen?

Why?

Correct Answer:

Verified

a.  NPVI = 23(3.17)- 64 = $9,000

NPVI = 23(3.17)- 64 = $9,000

NPVII = 34...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

NPVII = 34...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: At $1,000 par value,10 percent coupon bond

Q15: Which of the following should be included

Q17: Which of the following is not an

Q18: Ian is going to receive $20,000 six

Q19: 19.An investment costing $100,000 promises an after-tax

Q20: Pro forma free cash flows for a

Q21: A project will produce after-tax operating cash

Q23: Your grandmother invested a lump sum 26

Q24: Which of the following figures of merit

Q25: Consider the following investment opportunity. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2315/.jpg"