Essay

Tax Fighters,Inc.,develops,markets,and sells software for tax preparation.Tax Fighters,Inc.sells IRS Tax Fighter,a software for completing federal income tax forms and Gopher Basher,a software for completing Minnesota state income tax forms.For simplicity,assume that all of the costs in this industry are the fixed costs of developing the software packages themselves.The marginal cost of producing another disk is approximately zero.

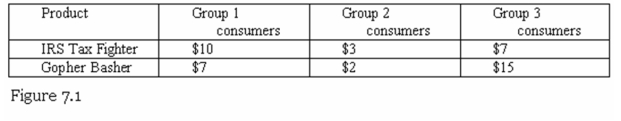

Consider the following information about the demand for tax software.There are an equal number of consumers in each group.Figure 7.1 shows the maximum that each type of consumer is willing to pay for each product.As vice president for pricing,explain your optimal bundling and pricing strategy to maximize Tax Fighter profits from the sale of tax software.Be sure to clearly explain why your strategy is.optimal.

Correct Answer:

Verified

Group 2 consumers have very low willingn...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Using the linear approximation system to estimate

Q30: Third-degree price discrimination results when a firm

Q31: Great Nuggets finds that there is a

Q32: If Tiger Toys faces a demand curve

Q33: Refer to Figure 7.2.If Happy Times Theater

Q35: The simple case of pricing with market

Q36: Refer to Figure 7.2.If Happy Times Theater

Q37: Refer to Figure 7.2.If Happy Times Theater

Q38: Using cost plus pricing,what is the price

Q39: If Tiger Toys faces a demand curve