Essay

You are provided with the following summary of overhead-related costs for the most recent accounting period for a company that uses a single overhead account, Factory Overhead, into which it records both actual and standard overhead costs during the period:

1. Overhead standard cost variances for the period:

a. Fixed overhead (FOH) spending variance = $1,600U

b. Production volume variance = $200F

c. Variable overhead (VOH) efficiency variance = $1,050U

d. Variable overhead (VOH) spending variance = $150U

2. Actual fixed overhead cost incurred (depreciation) = $15,800; actual variable overhead cost incurred (paid in cash) = $4,800

3. Standard overhead cost applied to production (i.e., WIP inventory) during the period = $18,000

4. Standard overhead cost of units transferred to Finished Goods Inventory = $20,000

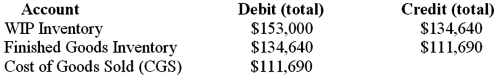

5. Before closing its accounts at the end of the period, the (standard cost) amounts affecting the inventory and CGS accounts is as follows:  Required: Prepare the proper journal entry for each of the following events:

Required: Prepare the proper journal entry for each of the following events:

1. Incurrence of actual FOH costs for the period.

2. Incurrence of actual VOH costs for the period.

3. Application of standard overhead costs to production (i.e., WIP inventory).

4. Recording of standard overhead costs for units completed during the period.

5. Recording of the four standard cost variances for the period.

6. Closing the standard cost variances under the assumption that the company closes these variances entirely to Cost of Goods Sold (CGS).

7. Closing the standard cost variances under the assumption that the company prorates the variances to the CGS and inventory accounts.

Correct Answer:

Verified

Answer may...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: What are the three steps in establishing

Q15: Systematic variances, as this term is used

Q21: Redtop Co. uses a standard cost system

Q34: The following information is available from

Q61: It can be argued that manufacturing overhead

Q82: Bluecap Co. uses a standard cost

Q90: Regarding the investigation of variances under uncertainty,

Q127: Megan, Inc. uses the following standard costs

Q133: The following information for the past

Q146: The following information for the past