Essay

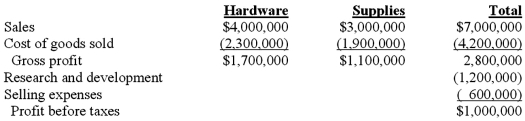

Gail Johnston is the CFO of Lancet Technologies, a manufacturer of parts and supplies for the cable TV industry. Gail has developed an analysis of the profitability of the firm's two main product lines, cable hardware, and cable supplies. Based on the analysis, she concludes that cable hardware is the most profitable of the firm's product lines.  Required:

Required:

1. Explain why Gail may be wrong in her assessment of the relative performances of the two product lines.

2. Suppose that 80 percent of the R&D and selling expenses are traceable to Hardware line. Prepare life-cycle income statements for each product and calculate the return on sales. What does this tell you about the importance of accurate life-cycle costing?

Correct Answer:

Verified

Answer may vary

Feedback: 1. Gail's anal...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Feedback: 1. Gail's anal...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Lens Care Inc. (LCI) manufactures specialized equipment

Q9: Quality Industries manufactures large workbenches for

Q17: Caldwell Company desires to enter a market

Q32: A type of strategic pricing based on

Q41: Ken Yalters, the COO of FreshSkin,

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2361/.jpg" alt=" Life Cycle Costing

Q58: The theory of constraints (TOC) approach is

Q58: Which one of the following is true

Q60: Bell Company produces and sells three products

Q68: Lens Care Inc. (LCI) manufactures specialized equipment