Multiple Choice

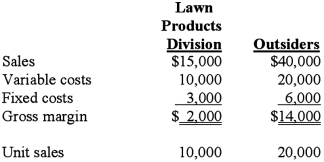

The Blade Division of Dana Company produces hardened steel blades. Approximately one-third of the Blade Division's output is sold to the Lawn Products Division of Dana; the remainder is sold to outside customers. The Blade Division's estimated sales and cost data for the year ending June 30 are as follows:  The Lawn Products Division has an opportunity to purchase 10,000 identical quality blades from an outside supplier at a cost of $1.25 per unit on a continual basis. Assume that the Blade Division cannot sell any additional products to outside customers. Based solely on short-term financial considerations, should Dana allow its Lawn Products Division to purchase the blades from the outside supplier, and why?

The Lawn Products Division has an opportunity to purchase 10,000 identical quality blades from an outside supplier at a cost of $1.25 per unit on a continual basis. Assume that the Blade Division cannot sell any additional products to outside customers. Based solely on short-term financial considerations, should Dana allow its Lawn Products Division to purchase the blades from the outside supplier, and why?

A) Yes, because buying the blades would save Dana Company $500.

B) No, because making the blades would save Dana Company $1,500.

C) Yes, because buying the blades would save Dana Company $2,500.

D) No, because making the blades would save Dana Company $2,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Which one of the following concepts is

Q21: Luther Company, located in Largeville, Kansas, is

Q24: Winona Johnson is the president of Johnson

Q25: Quinta Inc. manufactures machine parts for aircraft

Q27: Joe Green Enterprises has met all production

Q31: Plainfield Company manufactures part G for use

Q51: Harrington Corporation produces three products, A, B,

Q66: Manders Manufacturing Corporation uses the following model

Q91: Value streams are useful in decision-making because:<br>A)

Q99: In a joint production process, joint product