Multiple Choice

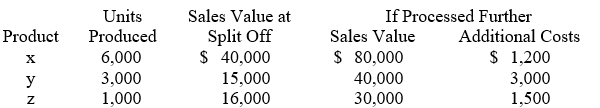

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product Y using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product Y using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

A) $20,341.

B) $25,352.

C) $27,042.

D) $33,687.

E) $67,606.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: The Merchant Manufacturing Company has two service

Q22: If a budgeted activity base is used

Q23: The Long Term Care Plus Company has

Q24: The most effective basis for cost allocation

Q25: Which of the following is an advantage

Q27: Beth Johnson was recently appointed Vice President

Q28: When significant differences exist in costs allocated

Q29: The Long Term Care Plus Company has

Q30: Garrison Co. produces three products — X,

Q31: The Merchant Manufacturing Company has two service