Essay

Demski Company has used a two-stage cost allocation system for many years. In the first stage, plant overhead costs are allocated to two production departments, P1 and P2, based on machine hours. In the second stage, Demski uses direct labor hours to assign overhead costs from the production departments to individual products A andB.

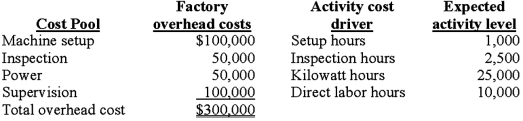

Budgeted factory overhead costs for the year are $300,000. Both the budgeted and actual machine hours in P1 and P2 are 12,000 and 28,000 hours, respectively.

After attending a seminar to learn the potential benefits of adopting an activity-based costing system (ABC), Ted Demski, the president of Demski Company, is considering implementing an ABC system. Upon his request, the controller at Demski Company has compiled the following information for analysis:

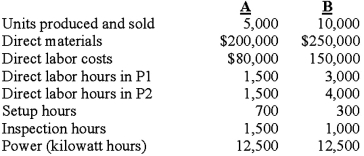

Demski manufactures two types of product, A and B, for which the following information is available:

Demski manufactures two types of product, A and B, for which the following information is available:

Required:

Required:

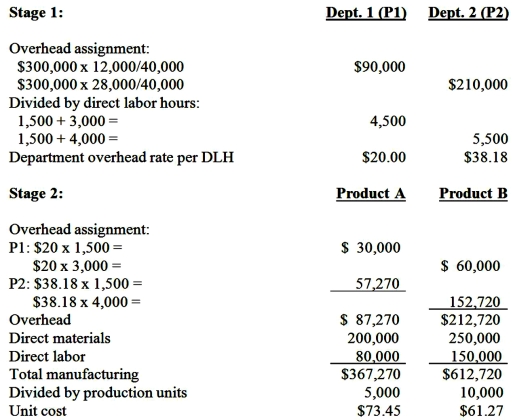

1. Determine the unit cost for each of the two products using the traditional two-stage allocation method. Round calculations to 2 decimal places.

2. Determine the unit cost for each of the two products using the proposed ABC system.

3. Compare the unit manufacturing costs for product A and product B computed in requirements 1 and 2.

(a) Why do two the cost systems differ in their total cost for each product?

(b) Why might these differences be important to the Demski Company?

Answer may vary

Feedback: 1. Unit cost for each of two products using the traditional two-stage allocation method:

Correct Answer:

Verified

Answer may vary

Feedback: 1. Unit cost f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Feedback: 1. Unit cost f...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Everlast Co. manufactures a variety of drill

Q10: Shaver Co. manufactures a variety of electric

Q11: Diamond Cleats Co. manufactures cleats for baseball

Q29: Costs at the unit-level of activity should

Q31: The examination of the efficiency of each

Q40: The use of activity-based costing is most

Q87: Shaver Co. manufactures a variety of electric

Q89: Which of the following is an example

Q129: National Inc. manufactures two models of CMD

Q146: Time-driven ABC provides a direct way to