Multiple Choice

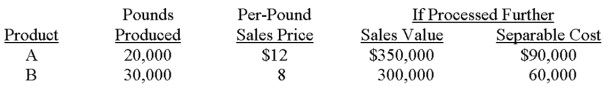

Zena Company manufactures two products (A and B) from a joint process that cost $200,000 for the year just ended.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Further information follows.

If the joint costs are allocated based on the physical-units method,the amount of joint cost assigned to product A would be:

A) $80,000.

B) $100,000.

C) $104,000.

D) $120,000.

E) some other amount.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The Gross Margin at Split-Off method should

Q36: Under dual-cost allocation, fixed costs are allocated

Q50: Ovation Corporation has two service departments (S1

Q52: Which of the following statements about joint-cost

Q54: Ojai Chemical manufactures two industrial chemicals in

Q55: Many companies use the dual-rate method of

Q56: Harvest Corporation has two service departments (S1

Q57: Which of the following methods accounts for

Q58: Which of the following methods ignores the

Q61: Use the following information to answer the