Essay

The following data pertain to Waters Corporation's residential humidifier:

A.Calculate the fixed selling and administrative cost allocated to each humidifier.

A.Price = total unit cost + (markup percentage * total unit cost)

$450 = X + (0.12 * X)

$450 = 1.12X

$401.79 = X

Because the total unit cost is $401.79,the allocated fixed selling and administrative cost would be $21.79 ($401.79 - $240.00 - $80.00 - $60.00).

B.

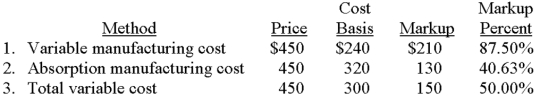

B.For each of the following bases,determine the appropriate percentage markup on cost that will result in a target price of $450 per humidifier: (1)variable manufacturing cost,(2)absorption manufacturing cost,and (3)total variable cost.(Round percentages to the nearest one-hundredth of a percent. )

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If the volume sold reacts strongly to

Q2: The difference between absorption manufacturing cost and

Q4: The following data pertain to Lemon Enterprises:

Q5: What price must Dexter charge if the

Q6: Which of the following formulas represents the

Q7: The four tasks that follow take place

Q10: Which of the following management tools is

Q10: From an economic perspective,a company's profit-maximizing quantity

Q11: The controller for Shutterbug Photographic Supply has

Q60: Which of the following terms describes a