Essay

Hempstead Corporation plans to manufacture 8,000 units over the next month at the following costs: direct materials,$480,000;direct labor,$60,000;variable manufacturing overhead,$150,000;straight-line depreciation,$24,000,and other fixed manufacturing overhead,$272,000.The result is total budgeted cost of $990,000.

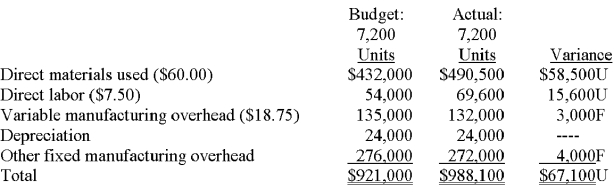

Shortly after the conclusion of the month,Hempstead reported the following costs:

A.

Budget calculations:

Direct materials used: $480,000 / 8,000 units = $60.00 per unit

Direct labor: $60,000 / 8,000 units = $7.50 per unit

Variable manufacturing overhead: $150,000 / 8,000 units = $18.75 per unit

A.Prepare a performance report that fairly compares budgeted and actual costs for the period just ended-namely,the report that the general manager likely used when assessing performance.

B.Should Krueger be praised for "having met the budget" or is the general manager's unhappiness justified? Explain,citing any apparent problems for the firm.

B.The general manager's unhappiness is appropriate because of the variances that have arisen.By comparing the original budget of $990,000 vs.actual costs of $988,100,Krueger appears to have met the budget.Bear in mind,though,that volume was below the original monthly expectation of 8,000 units-presumably because of the plant closure.A reduced volume will likely lead to lower variable costs than anticipated (and resulting favorable variances).

When the volume differential is removed,variable cost variances turn unfavorable for direct materials and direct labor.These two amounts are,respectively,13.5% and 28.9% greater than budget.

Correct Answer:

Verified

Howard Krueger and his crews turned ou...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Howard Krueger and his crews turned ou...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Jackson Corporation uses a standard cost system,applying

Q16: In an effort to reduce record-keeping,companies that

Q18: Draco's fixed-overhead volume variance is:<br>A)$4,000 favorable.<br>B)$4,000 unfavorable.<br>C)$10,000

Q19: The activity measure selected for use in

Q21: Which variance is commonly associated with measuring

Q22: If Rowe prepared an overhead cost performance

Q23: Draco's variable-overhead efficiency variance is:<br>A)$550 favorable.<br>B)$550 unfavorable.<br>C)$4,800

Q24: A flexible budget is appropriate for a:

Q25: The difference between budgeted fixed manufacturing overhead

Q44: A production manager was recently given a