Multiple Choice

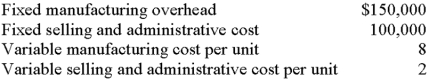

Chino began business at the start of the current year.The company planned to produce 25,000 units,and actual production conformed to expectations.Sales totaled 22,000 units at $30 each.Costs incurred were:

If there were no variances,the company's absorption-costing income would be:

A) $190,000.

B) $202,000.

C) $208,000.

D) $220,000.

E) some other amount.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Income reported under absorption costing and variable

Q10: For external-reporting purposes, generally accepted accounting principles

Q26: Which of the following situations would cause

Q31: The gross margin that the company would

Q33: Indiana's per-unit inventoriable cost under absorption costing

Q34: Delaware has computed the following unit costs

Q35: All of the following costs are inventoried

Q37: Consider the following statements about absorption costing

Q43: Consider the following statements about absorption- and

Q61: Absorption costing is required for tax purposes.