Multiple Choice

Martin and Beasley,an accounting firm,provides consulting and tax planning services.For many years,the firm's total administrative cost (currently $270,000) has been allocated to services on this basis of billable hours to clients.A recent analysis found that 55% of the firm's billable hours to clients resulted from tax planning services,while 45% resulted from consulting services.

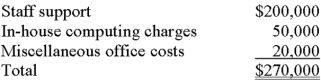

The firm,contemplating a change to activity-based costing,has identified three components of administrative cost,as follows:

A recent analysis of staff support found a strong correlation with the number of clients served.In contrast,in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions,respectively.Consulting clients served totaled 35% of the total client base,consumed 30% of the firm's computer hours,and accounted for 20% of the total client transactions.

If Martin and Beasley switched from its current accounting method to an activity-based costing system,the amount of administrative cost chargeable to consulting services would:

A) decrease by $32,500.

B) increase by $32,500.

C) decrease by $59,500.

D) change by an amount other than those listed above.

E) change,but the amount cannot be determined based on the information presented.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is least likely

Q24: The adoption of a 24/7 employee hotline

Q37: Management of Laredo Enterprises recently decided to

Q38: Which of the following statements regarding the

Q39: Hudson,Inc. ,is considering a change from a

Q40: Harvest Corporation recently abandoned its traditional production

Q47: Which of the following can have a

Q50: In an activity-based costing system, materials receiving

Q64: Templeton Industries currently assigns overhead to products

Q77: Widely varying consumption ratios:<br>A) are reflective of