Essay

The wholesale division of Navigator Enterprises is considering the installation of a just-in-time purchasing system.The company's accountant has provided the following figures if the system is adopted:

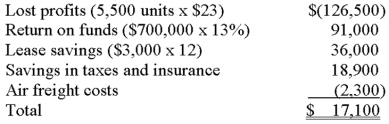

· Sales lost because of out-of-stock situations will total 5,500 units,with each unit producing an average profit for the firm of $23.

· The overall inventory will drop by $700,000.Navigator can invest these funds elsewhere and produce a return of 13%.

· A leased warehouse (monthly rent of $3,000)will no longer be needed.

· Two warehouse employees (total annual salary cost of $43,000)will be transferred elsewhere in the firm.

· Annual property taxes and insurance are expected to fall by $18,900.

· In order to keep valued customers,Navigator will occasionally have to use air freight when an out-of-stock situation arises,resulting in added cost for the company of $2,300.

Required:

A.

The just-in-time system is financially advantageous to the firm,saving $17,100.Note: The cost of the warehouse employees is ignored because regardless of whether the system is adopted,Navigator will incur the cost.

A.Determine whether it is financially advantageous over a 12-month period for Navigator to adopt the just-in-time system.

B.How would Navigator describe the "ideal supplier" if the company adopts the just-in-time system.

B.The "ideal supplier" is one that delivers top quality goods precisely when needeD.Thus,reliability is a key with respect to quality and delivery,as is close proximity to the wholesale division.Most JIT suppliers are willing to sign long-term contracts and accept "batched" payments for deliveries.

Correct Answer:

Verified

A.

The just-in-time system is financia...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The just-in-time system is financia...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: What is HiTech's pool rate for the

Q9: Drake Manufacturing sells a number of goods

Q14: Aladin's customer service department follows up on

Q15: In an activity-based costing system, direct materials

Q15: The division of activities into unit-level,batch-level,product-sustaining level,and

Q36: Which of the following is not an

Q44: Activity-based costing systems:<br>A) use a single, volume-based

Q52: Of the following organizations, activity-based costing (ABC)

Q79: St. Helena Cellars produces wine in northern

Q98: Activity-based costing systems have a tendency to