Multiple Choice

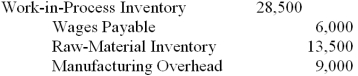

Job no.C12 was completed in November at a cost of $28,500,subdivided as follows: direct material,$13,500;direct labor,$6,000;and manufacturing overhead,$9,000.The journal entry to record the completion of the job is:

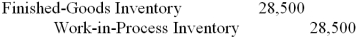

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Reynardo Company incurred $90,000 of depreciation for

Q38: Othello Manufacturing incurred $106,000 of direct labor

Q44: Huxtable charges manufacturing overhead to products by

Q52: Summers Corporation recently used $75,000 of direct

Q62: At the Nassau Advertising Agency,partner and staff

Q64: The primary difference between normalized and actual

Q68: Howard Manufacturing's overhead at year-end was underapplied

Q70: Under- or overapplied manufacturing overhead at year-end

Q71: Which of the following statements about material

Q79: Electricity costs that were incurred by a