Essay

Xi Manufacturing,which began operations on January 1 of the current year,produces an industrial scraper that sells for $325 per unit.Information related to the current year's activities follows.

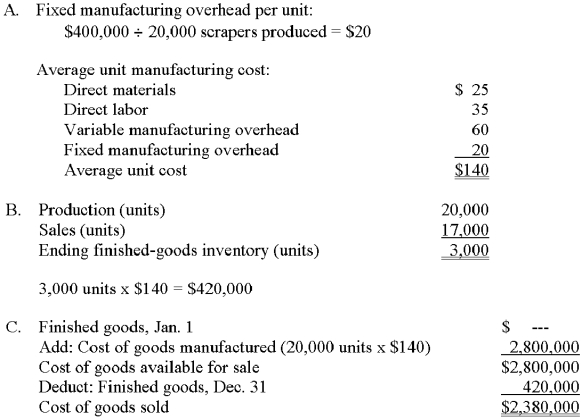

A.Compute the company's average unit cost of production.

B.Determine the cost of the December 31 finished-goods inventory.

C.Compute the company's cost of goods sold.

D.1.No change.Direct labor is a variable cost,and the cost per unit will remain constant.

2.No change.Despite the increase in the number of units produced,this is a fixed cost,which remains the same in total.

D.If next year's production increases to 23,000 units and general cost behavior patterns do not change,what is the likely effect on:

1.The direct-labor cost of $35 per unit? Why?

2.The fixed manufacturing overhead cost of $400,000? Why?

Correct Answer:

Verified

Xi carries its finished-goods inventor...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Xi carries its finished-goods inventor...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: If purchases of raw materials were $135,000

Q8: Baxter Company,which pays a 10% commission to

Q9: The variable costs per unit are $6

Q13: Lake Appliance produces washers and dryers in

Q17: Which of the following employees of a

Q31: Which of the following statements is true?<br>A)

Q33: Which of the following entities would most

Q51: Describe the economic characteristics of sunk costs

Q70: Finished goods inventory is ordinarily held for

Q110: Use the following information to answer the