Multiple Choice

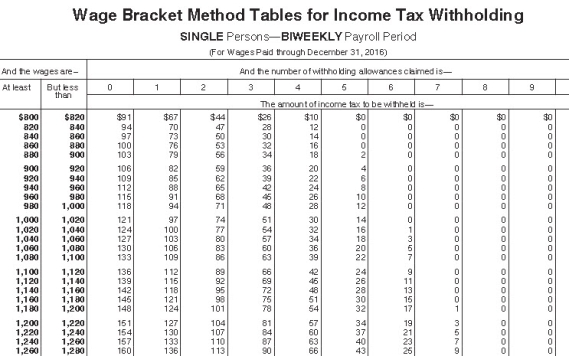

Caroljane earned $1,120 during the most recent pay biweekly pay period.She contributes 4% of her gross pay to her 401(k) plan.She is single and has 1 withholding allowance.Based on the following table,how much federal income tax should be withheld from her pay?

A) $115.00

B) $109.00

C) $112.00

D) $106.00

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Why might an employee elect to have

Q22: Social Security tax has a wage base,

Q23: Maile is a full-time exempt employee in

Q28: The annual payroll tax guide that the

Q30: Federal income tax,Medicare tax,and Social Security tax

Q31: Natalia is a full-time exempt employee who

Q32: Jeannie is an adjunct faculty at a

Q35: Which of the following may be included

Q35: Wyatt is a full-time exempt music engineer

Q61: Why do employers use checks as an