Multiple Choice

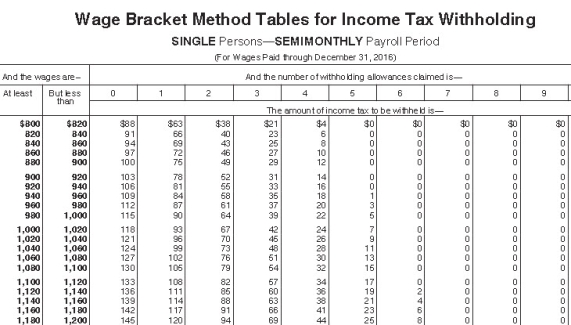

Julio is single with 1 withholding allowance.He earned $1,025.00 during the most recent semimonthly pay period.He needs to decide between contributing 3% and $30 to his 401(k) plan.If he chooses the method that results in the lowest taxable income,how much will be withheld for federal income tax (based on the following table) ?

A) $65.00

B) $87.00

C) $90.00

D) Both yield the same tax amount

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following payment methods is

Q15: Garnishments are court-ordered amounts that an employer

Q33: The regular Medicare tax deduction is 1.45%

Q40: Which of the following best describes a

Q42: Tierney is a full-time nonexempt salaried employee

Q43: The percentage of the Medicare tax withholding

Q46: Ramani earned $1,698.50 during the most recent

Q53: Which of the following is the correct

Q69: Which of the following is true about

Q69: Which of the following deductions may be