Multiple Choice

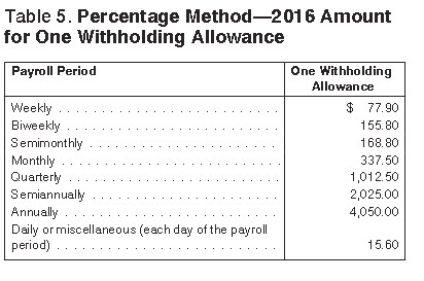

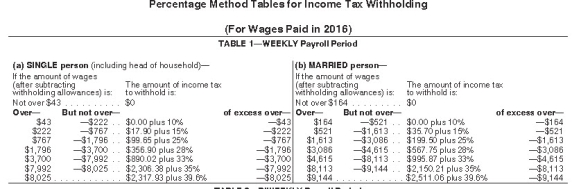

Olga earned $1,558.00 during the most recent weekly pay period.She is single with 2 withholding allowances and no pre-tax deductions.Using the percentage method,compute Olga's federal income tax for the period.(Do not round intermediate calculations.Round final answer to two decimal places. )

A) $277.93

B) $339.25

C) $258.45

D) $314.75

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Warren is a married employee with six

Q7: State and Local Income Tax rates _.<br>A)

Q8: The purpose of the wage base used

Q10: Charitable contributions are an example of post-tax

Q13: Retirement fund contributions are considered Pre-Tax Deductions

Q14: Collin is a full-time exempt employee in

Q19: Which body issued Regulation E to protect

Q33: What is an advantage of direct deposit

Q43: Disposable income is defined as:<br>A)An employee's net

Q60: The factors that determine an employee's federal