Essay

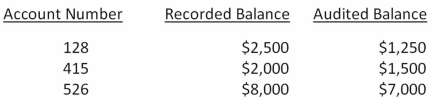

W.Fire,CPA is examining the accounts receivable (which were recorded at $500,000)for TBB,Inc.,using a monetary unit sampling application.Using a risk of incorrect acceptance of 5% and a tolerable misstatement of $50,000,Fire has determined a sample size of 100 items and found the following three misstatements  a.What sampling interval did Fire use?

a.What sampling interval did Fire use?

b.Based on the preceding information,calculate the (1)actual misstatement,(2)projected misstatement,(3)incremental allowance for sampling risk,and (4)basic allowance for sampling risk.

c.What is the upper limit on misstatement?

d.Based on the preceding information,what would Fire's conclusion be with respect to TBB's accounts receivable balance?

Correct Answer:

Verified

a.Sampling interval = $500,000 ÷ 100 ite...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: If a customer's account was recorded at

Q26: An auditor may decide to increase the

Q80: Variables sampling is used primarily when the

Q81: The risk of incorrect rejection typically results

Q82: The auditor's sample would indicate that the

Q83: The _ is the difference between the

Q84: When the audit risk is 0.015,inherent risk

Q88: Which of the following would not cause

Q89: How does monetary unit sampling (MUS)ensure that

Q90: Which of the following expresses the relationship