Multiple Choice

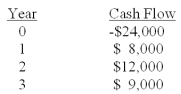

An investment has the following cash flows.Should the project be accepted if it has been assigned a required return of 9.5%? Why or why not?

A) Yes; because the IRR exceeds the required return by about 0.39%

B) Yes; because the IRR is less than the required return by about 3.9%

C) Yes; because the IRR is positive

D) No; because the IRR exceeds the required return by about 3.9%

E) No; because the IRR is 9.89%

Correct Answer:

Verified

Correct Answer:

Verified

Q55: All else equal,the payback period for a

Q63: List and briefly discuss the advantages and

Q82: A mutually exclusive project is a project

Q103: Which of the following methods of project

Q104: The profitability index is the ratio of:<br>A)average

Q105: Based on the profitability index (PI)rule,should a

Q108: Given the goals of firm value and

Q110: A project has an initial cost of

Q111: Consider an investment with an initial cost

Q112: Based upon the average accounting return (AAR)and