Multiple Choice

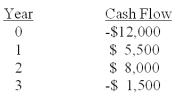

You are considering an investment with the following cash flows.If the required rate of return for this investment is 13.5%,should you accept it based solely on the internal rate of return rule? Why or why not?

A) Yes; because the IRR exceeds the required return

B) Yes; because the IRR is a positive rate of return

C) No; because the IRR is less than the required return

D) No; because the IRR is a negative rate of return

E) You can not apply the IRR rule in this case because there are multiple IRRs.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: In actual practice,managers frequently use the:<br>I.AAR because

Q12: Based on the net present value of

Q13: The discounted payback period of a project

Q14: The primary reason that a company's projects

Q15: Based upon the payback period and the

Q16: The internal rate of return (IRR): I.

Q19: The internal rate of return for a

Q20: What is the net present value of

Q21: Based on the payback period of _

Q68: The problem of multiple IRRs can occur