Multiple Choice

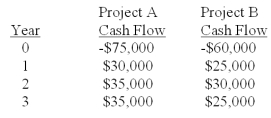

The Winston Co.is considering two mutually exclusive projects with the following cash flows.The incremental IRR is _____ and if the required rate is higher than the crossover rate then project _____ should be accepted.

A) 13.94%; A

B) 13.94%; B

C) 15.44%; A

D) 15.44%; B

E) 15.86%; A

Correct Answer:

Verified

Correct Answer:

Verified

Q4: When two projects both require the total

Q5: The profitability index is closely related to:<br>A)payback.<br>B)discounted

Q6: Which of the following does not characterize

Q7: The Liberty Co.is considering two projects.Project A

Q8: What is the internal rate of return

Q10: Based on the payback period of _

Q11: In actual practice,managers frequently use the:<br>I.AAR because

Q12: Based on the net present value of

Q13: The discounted payback period of a project

Q14: The primary reason that a company's projects