Essay

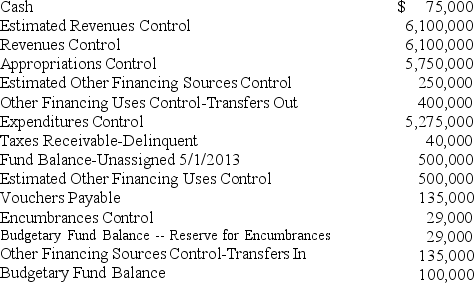

The City of Morganville had the following preclosing account balances in its General Fund as of April 30,2014.Debits and credits are not separated; each account had its "normal" balance.Among the expenditures recorded this year is an amount expended on supplies ordered at the end of the previous year.Assume that encumbrances do not lapse and that the City failed to make the journal entry(s)necessary to re-establish the encumbrance in the current year.

Required:

(a)Prepare all entries necessary to close the General Fund of the City of Morganville.

(b)Prepare a Statement of Revenues,Expenditures,and Changes in Fund Balance for the General Fund for the City of Morganville for the Year Ended April 30,2014.End with the ending fund balance.This is the GAAP operating statement.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: What is the different accounting treatment with

Q6: The City of Pine Cove levied property

Q8: Which of the following is an interfund

Q11: The following transactions occurred in the General

Q19: Special revenue funds are used when it

Q36: What is the difference between reciprocal interfund

Q61: Special revenue funds are used when it

Q101: The journal entry to record an encumbrance

Q101: Receivables from sales taxes are recorded in

Q131: Expenditures for claims and judgments, compensated absences,