Multiple Choice

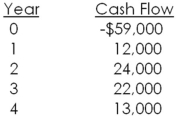

The Flour Baker is considering a project with the following cash flows.Should this project be accepted based on its internal rate of return if the required return is 11 percent?

A) Yes, because the project's rate of return is 7.78 percent

B) Yes, because the project's rate of return is 9.36 percent

C) No, because the project's rate of return is 7.78 percent

D) No, because the project's rate of return is 9.36 percent

E) No, because the project's rate of return is 13.08 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Which one of the following is the

Q68: The net present value profile illustrates how

Q80: Discounted cash flow valuation is the process

Q81: What is the NPV of the following

Q82: Which one of the following is specifically

Q83: Auto Detailers is buying some new equipment

Q85: Textiles Unlimited has gathered projected cash flows

Q86: The net present value of a project's

Q87: You are making a $120,000 investment and

Q89: The Greasy Spoon Restaurant is considering a