Multiple Choice

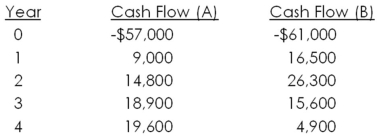

Baker's Supply imposes a payback cutoff of 3.5 years for its international investment projects.If the company has the following two projects available,should it accept either of them?

A) Accept both Projects A and B

B) Accept Project A but not Project B

C) Accept Project B but not Project A

D) Both Project A and B are acceptable but you can select only one project

E) Reject both Projects A and B

Correct Answer:

Verified

Correct Answer:

Verified

Q2: You were recently hired by a firm

Q8: Based on the most recent survey information

Q65: A project has expected cash inflows,starting with

Q66: An investment has an initial cost of

Q67: What is the net present value of

Q69: You are considering the following two mutually

Q71: What is the net present value of

Q72: In which one of the following situations

Q73: You are considering an equipment purchase costing

Q96: The average net income of a project