Multiple Choice

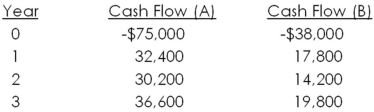

Jefferson International is trying to choose between the following two mutually exclusive design projects:  The required return is 12 percent.If the company applies the profitability index (PI) decision rule,which project should the firm accept?

The required return is 12 percent.If the company applies the profitability index (PI) decision rule,which project should the firm accept?

If the company applies the NPV decision rule,which project should it take?

Given your first two answers,which project should the firm actually accept?

A) Project A; Project B; Project A

B) Project A; Project B; Project B

C) Project B; Project A; Project A

D) Project B; Project A; Project B

E) Project B; Project B, Project B

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The possibility that more than one discount

Q73: The Golden Goose is considering a project

Q77: Which one of the following will occur

Q83: The payback period is the length of

Q85: Which one of the following statements is

Q91: Which one of the following statements is

Q92: Which one of the following indicators offers

Q93: What is the payback period for a

Q94: A project has the following cash flows.What

Q97: A firm is reviewing a project that