Multiple Choice

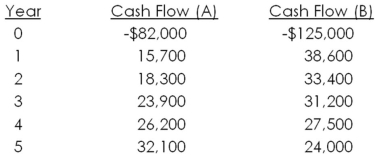

Quattro,Inc.has the following mutually exclusive projects available.The company has historically used a four-year cutoff for projects.The required return is 11 percent.  The payback for Project A is ____ while the payback for Project B is ____.The NPV for Project A is _____ while the NPV for Project B is ____.Which project,if any,should the company accept?

The payback for Project A is ____ while the payback for Project B is ____.The NPV for Project A is _____ while the NPV for Project B is ____.Which project,if any,should the company accept?

A) 3.92 years; 3.64 years; $780.85; $1,211.48; accept both Project A and B

B) 3.92 years; 3.79 years; -$211.60; $1,211.48; accept Project B only

C) 3.92 years; 3.79 years; $780.85; -$7,945.93; accept Project A only

D) 4.06 years; 3.64 years; $780.85; $1,211.48; accept both Project A and B

E) 4.06 years; 3.79 years; -$211.60; -$7,945.93; reject both projects

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Chasteen,Inc.is considering an investment with an initial

Q5: Which one of the following defines the

Q6: What is the net present value of

Q7: The modified internal rate of return is

Q8: The internal rate of return is unreliable

Q11: Delta Mu Delta is considering purchasing some

Q12: Molly is considering a project with cash

Q13: A proposed project requires an initial cash

Q14: Miller Brothers is considering a project that

Q90: The average accounting return:<br>A)measures profitability rather than