Multiple Choice

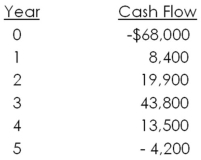

Miller and Sons is evaluating a project with the following cash flows:  The company uses a 10 percent interest rate on all of its projects.What is the MIRR of the project using the reinvestment approach?

The company uses a 10 percent interest rate on all of its projects.What is the MIRR of the project using the reinvestment approach?

The discounting approach?

The combination approach?

A) 8.46 percent; 7.29 percent; 8.59 percent

B) 8.46 percent; 7.38 percent; 8.61 percent

C) 8.54 percent; 7.29 percent; 8.61 percent

D) 8.54 percent; 7.38 percent; 8.59 percent

E) 8.54 percent; 8.23 percent; 8.61 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Which one of the following indicates that

Q68: The net present value profile illustrates how

Q71: What is the net present value of

Q72: In which one of the following situations

Q73: You are considering an equipment purchase costing

Q75: You're trying to determine whether or not

Q77: Diamond Enterprises is considering a project that

Q78: What is the payback period for a

Q80: Discounted cash flow valuation is the process

Q81: What is the NPV of the following