Essay

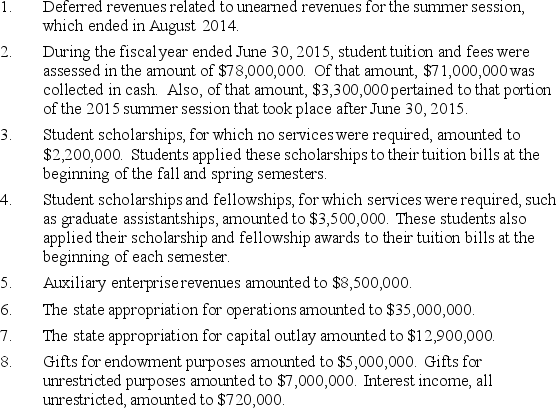

Southeastern State University has chosen to report as a public university reporting as a special-purpose entity engaged only in business-type activities. Deferred Revenues were reported as of July 1,2014 in the amount of $5,000,000. Record the following transactions related to revenue recognition for the year ended June 30,2015. Include in the account titles the proper revenue classification (operating revenues,nonoperating revenues,etc.):

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Public colleges and universities that choose to

Q6: Special-purpose governments generally provide a limited set

Q51: For financial reporting purposes, governmental health care

Q72: Special-purpose governments that are engaged in both

Q77: With respect to public colleges engaged in

Q81: Public colleges and universities are required to

Q85: Which of the following is true regarding

Q86: Fees waived by the an educational institution

Q87: What are the criteria outlined in GASB

Q92: With respect to public colleges and universities,