Essay

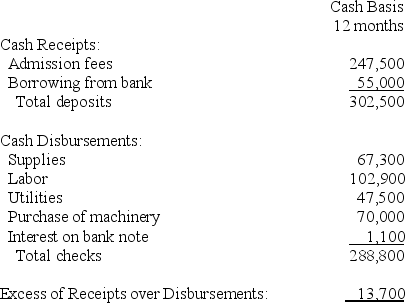

The following Statement of Cash Receipts and Disbursements was prepared by the bookkeeper of The Anchorage Arboretum Authority. The Arboretum Authority is a component unit of the City of Anchorage and must be included in the City's financial statements. It began operations on January 1,2015 with no outstanding liabilities or commitments and only 2 assets:

(1)$15,000 cash and (2)land that it had paid $ 23,000 to acquire.

•The loan from the bank is dated April 1 and is for a five year period. Interest (4% annual rate)is paid on Oct.1 and April 1 of each year,beginning October 1,2015.

•The loan from the bank is dated April 1 and is for a five year period. Interest (4% annual rate)is paid on Oct.1 and April 1 of each year,beginning October 1,2015.

•The machinery was purchased on April 1 with the proceeds provided by the bank loan and has an estimated useful life of 10 years.(straight-line basis)

•Supplies on hand amounted to $ 3,760 at December 31,2015. These included $650 of fertilizer that was received on December 29 and paid in January 2015.All other bills and salaries related to 2015 had been paid by close of business on December 31.

Required:

Part A.Prepare a Statement of Revenues,Expenses and Changes in Net Position for the year ended 12-31-09 for the Arboretum assuming the City plans to account for its activities on the accrual basis.

Part B.Prepare a Statement of Revenues,Expenditures and Changes in Fund Balance for the year ended 12-31-09 for the Arboretum assuming the City plans to account for its activities on the modified accrual basis.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Solid waste landfills are required to estimate

Q61: Which of the following would be found

Q73: The estimated costs of closure of solid

Q77: Describe the accounting required for risk management

Q78: Which of the following statements is true

Q80: Describe the accounting required by the GASB

Q86: Which of the following would <b><u>not</b></u>

Q111: Proprietary funds do not record capital assets,

Q112: This fund accounts for activities that produce

Q126: When an activity is created to provide