Essay

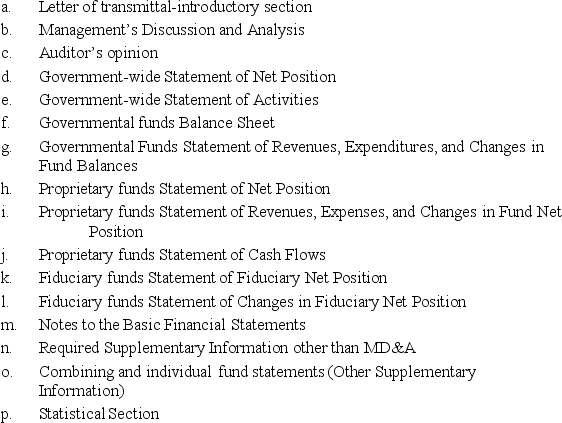

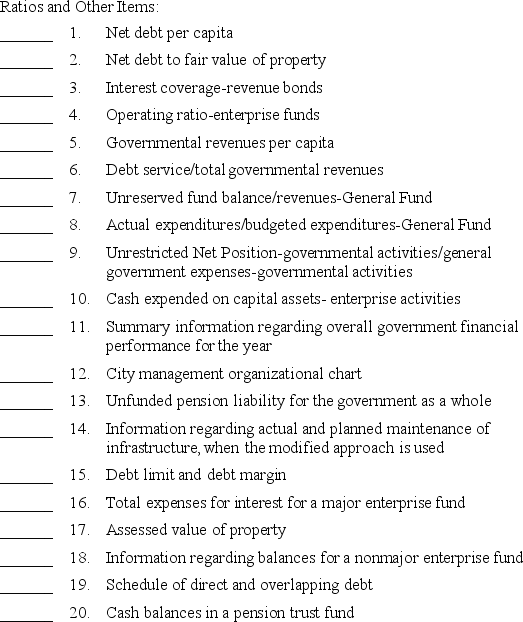

The Comprehensive Annual Financial Report of a local governmental unit includes several statements and sections. When a financial analyst is computing ratios and extracting other information,he or she needs to know where in the CAFR to look. Use the following classification to indicate where an analyst would look in the CAFR to compute the ratios and gather information by placing the appropriate letter(s)in the space next to each item. When possible,choose the location in the basic financial statements or notes that would be subject to examination:

Correct Answer:

Verified

1-d; 2-d,p; 3-i; 4-i; 5-g,p; 6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Section 501c3, exempt organizations are prohibited from

Q74: The use of opinion units allows an

Q75: What is the maximum threshold for a

Q81: Which type of audit opinion is appropriate

Q82: Tax-exempt organizations are required to pay tax

Q83: The highest bond rating assigned by Moody's

Q84: The IRS announced that it considers tax-exempt

Q95: Government financial audits must comply with the

Q127: What is required for an organization to

Q139: Which of the following is not part