Multiple Choice

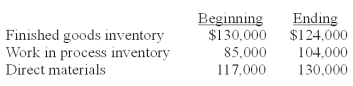

Assume the following information pertaining to Moonbeam Company:

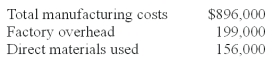

Costs incurred during the period are as follows:

Cost of goods sold is calculated to be:

A) $890,000.

B) $896,000.

C) $883,000.

D) $877,000.

E) $870,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: Factory overhead costs for a given period

Q20: Fisher,Inc.recently lost a portion of its records

Q21: Fisher,Inc.recently lost a portion of its records

Q22: Assume the following information pertaining to Moonbeam

Q25: Direct materials and direct labor costs total

Q27: Which of the following should be considered

Q34: The cost of goods that were finished

Q42: If finished goods inventory has increased during

Q64: Which of the following is normally considered

Q81: Advanced Technical Services Ltd., has many products