Multiple Choice

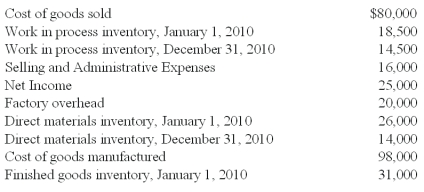

Tierney Construction,Inc.recently lost a portion of its financial records in an office theft.The following accounting information remained in the office files:

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of total manufacturing cost?

A) $83,000.

B) $94,000.

C) $108,000.

D) $75,000.

= $94,000 = $24,000 Direct Materials Used + $50,000 Direct Labor + $20,000

Overhead = $94,000 Total Manufacturing Cost

Where Direct Labor = 2.5($20,000) = $50,000

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which of the following best describes a

Q50: The Gray Company has a staff of

Q60: The change in total cost associated with

Q69: Assume the following information pertaining to Cub

Q71: In order to assure that accounting information

Q72: The following data pertains to Lam Co.'s

Q73: Lester-Sung,Inc.is a large general construction firm in

Q76: The following information was taken from the

Q77: Structural cost drivers are to executional cost

Q78: Williams Company is an East Coast producer