Multiple Choice

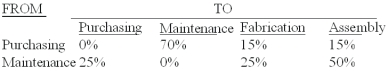

The Sakicki Manufacturing Company has two service departments - purchasing and maintenance,and two production departments - fabrication and assembly.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs) were as follows:

Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the fabrication department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar) :

A) $114,800.

B) $117,909.

C) $116,091.

D) $108,000.

E) $119,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Revenue methods of by-product cost allocation are

Q18: Which one of the following methods uses

Q64: Hartwicke Manufacturing Company has two service departments

Q65: Marin Products produces three products - DBB-1,DBB-2,and

Q66: For the purposes of cost accumulation,which of

Q67: Cost allocation provides a services firm a

Q68: The concepts of cost allocation that are

Q70: Russell Co.produces three products - U,V,and W

Q72: The Sakicki Manufacturing Company has two service

Q74: Russell Co.produces three products - U,V,and W