Multiple Choice

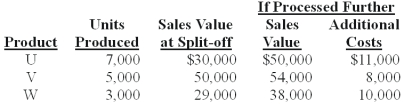

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product W using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar) :

A) $19,266.

B) $32,110.

C) $18,624.

D) $28,496.

E) $17,345.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Revenue methods of by-product cost allocation are

Q55: By-product costing approaches include:<br>A)Activity-based approach.<br>B)Cost approach.<br>C)Asset recognition

Q74: Russell Co.produces three products - U,V,and W

Q75: The Insurance Plus Company has two service

Q76: Dual allocation is a cost allocation approach

Q77: Hatchett Inc.produces joint products L,M,and N from

Q79: The Chapman Manufacturing Company has two service

Q81: Hatchett Inc.produces joint products L,M,and N from

Q82: The Insurance Plus Company has two service

Q83: The Sakicki Manufacturing Company has two service