Multiple Choice

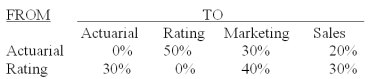

The Insurance Plus Company has two service departments - actuarial and premium rating,and two production departments - marketing and sales.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs) were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the marketing department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar) :

A) $52,857.

B) $60,000.

C) $112,857.

D) $130,000.

E) $142,857.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Cost allocation of shared facilities cost is

Q37: Taylor Inc.produces joint products A,B,and C from

Q39: Hartwicke Manufacturing Company has two service departments

Q40: Johns Company manufactures products R,S,and T from

Q41: The departmental approach of cost allocation recognizes

Q46: The Insurance Plus Company has two service

Q54: By-product costing that uses the asset recognition

Q61: Which one of the following methods of

Q66: The reciprocal method can be solved using

Q76: The cost allocation method most widely used