Multiple Choice

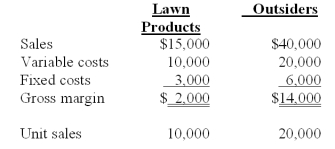

The Blade Division of Dana Company produces hardened steel blades.Approximately one-third of the Blade Division's output is sold to the Lawn Products Division of Dana;the remainder is sold to outside customers.The Blade Division's estimated sales and cost data for the year ending June 30 are as follows:

The Lawn Products Division has an opportunity to purchase 10,000 identical quality blades from an outside supplier at a cost of $1.25 per unit on a continual basis.Assume that the Blade Division cannot sell any additional products to outside customers.Should Dana allow its Lawn Products Division to purchase the blades from the outside supplier,and why?

A) Yes,because buying the blades would save Dana Company $500.

B) No,because making the blades would save Dana Company $1,500.

C) Yes,because buying the blades would save Dana Company $2,500.

D) No,because making the blades would save Dana Company $2,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: The major problem with relevant cost determination

Q24: A decision bias is an inherent tendency

Q25: Which one of the following is most

Q26: The Sand Cruiser is a takeout food

Q27: A truck,costing $25,000 and uninsured,was wrecked the

Q28: The Car Lot is a New York

Q30: The Tee Box is a golf shop

Q31: The time value of money is:<br>A)Never relevant.<br>B)Relevant

Q32: When using relevant cost analysis,it is a

Q33: The decision to keep or drop products